mage & data: BloombergNEF.

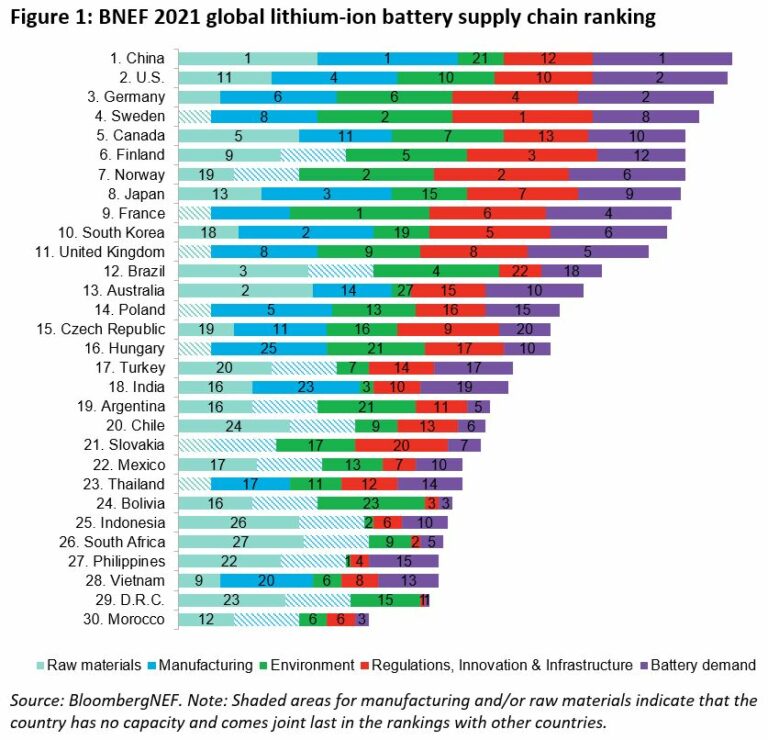

China has once again been ranked top for involvement in the global lithium-ion battery supply chain by BloombergNEF, but for the first time the US has come in second amid a policy rush to support the domestic industry.

BloombergNEF published its annual ‘Global lithium-ion battery supply chain ranking’ report for the first time in 2020, finding China to be the unsurprising leader, with Japan and then South Korea in second and third place. The US was in sixth place last year.

The second edition of the report has just been published and this year the analysis firm finds that continued investment as well as strong local and international demand keeps China at the top of the tree not only in 2021 but also in projections out to 2026.

More than 80% of all battery cell manufacturing is in China and within five years production in the country could reach 2TWh, BloombergNEF said. However, governments around the world are recognising the strategic importance of having battery industry supply chains, or key elements of supply chains within their borders.

This is true of the US. Since Joe Biden took office as president, his administration has ordered strategic reviews into battery supply chains and Secretary of Energy Jennifer Granholm has made it a priority to seek industry input to figure out what can be done to foster development. Even before Biden’s tenure began, key materials like lithium and cobalt had been placed on US government critical materials lists.

Investments in the US’ manufacturing base thus far have been made by Asian companies like SK Innovation and LG Energy Solution, both building gigafactories there, and by Tesla with its first Gigafactory in Nevada. So far the only new announcement of a gigafactory in development by a US-owned company has been stationary storage startup KORE Power’s 12GWh facility in Arizona.

BloombergNEF head of energy storage James Frith said that while individual companies like Tesla previously “had to forge a path by themselves,” there is now policy support in place. The US has “many of the ingredients needed to foster a domestic lithium-ion battery value chain,” Frith said.

With policy support, “we are seeing a coordinated effort from companies across the supply chain to anchor more value within the country,” he said.

One caveat to the findings is that European countries have been ranked individually, rather than taking Europe or the European Union — which is strongly supporting the development of dozens of gigawatt-hours of production capacity — as one region.

Indeed, if ranking Europe as one country, it would be first in both 2021’s table and 2026 projections, with battery demand second only to China and the ability for tariff-free trade in Europe strengthening industry players’ position. Two European countries, Germany and Sweden, rank in the 2021 top five nonetheless.

“Europe has set the ambitious goal of supplying all of its own battery demand for the region by 2025, and has committed billions of euros in state aid to attract investments in the battery supply chain,” BloombergNEF energy storage analyst Cecilia L’Ecluse said.

“We are now starting to see the results of this effort.”

Low-carbon power cheaply available in the Nordic countries of Europe have made them a hub for attracting investment: in Sweden, Northvolt is building 60GWh of annual cell production capacity, a large refinery for nickel and cobalt sulfate is being built in Finland, with the two countries ranking fourth and sixth for 2021.

Japan and South Korea have fallen down the rankings, to eighth and 10th respectively, but Japan in particular is expected to rebound to third place among countries by 2026, which BloombergNEF expects will be driven by rising domestic demand and continued investment in materials refining as well as component production.

However, with the rankings also being based in part on environmental and sustainability criteria, the high carbon content of power grids in both East Asian countries marks them down.

Another BloombergNEF analyst, Allan Ray Restauro, a metals expert, cited Finland and Canada as two regions “looking to provide a greener alternative for battery metals supply”.

Interestingly, after the European Union announced regulations for the battery supply chain that will include safeguards to limit the criticial materials content of batteries, creation of recycling value chains, carbon footprint transparency and more, some in the European industry said the rules, due to come into effect gradually over the next few years risked some unintended consequences of making domestic suppliers less competitive. China and South Korea already have in place rules on recycled content and materials recovery.

Availability of raw material resources is not necessarily an indicator that a country will be ranked highly by BloombergNEF’s criteria: domestic battery supply chains and battery demand are often lacking in these places. Hence, lithium-rich Chile ranks 20th in the world in 2020 and conversely, James Frith noted that China accounts for the majority of battery metal refining capacity, despite the country being “resource poor”.

“In countries that don’t have abundant resources, policy often overlooks the raw materials,” Frith tweeted yesterday.

“For other countries to attract this industry, policymakers need to turn their attention to it.”

Privacy Statement Copyright © 2018 SHENZHEN GSL ENERGY TECH CO LTD